Do you really need that? No, you don’t.

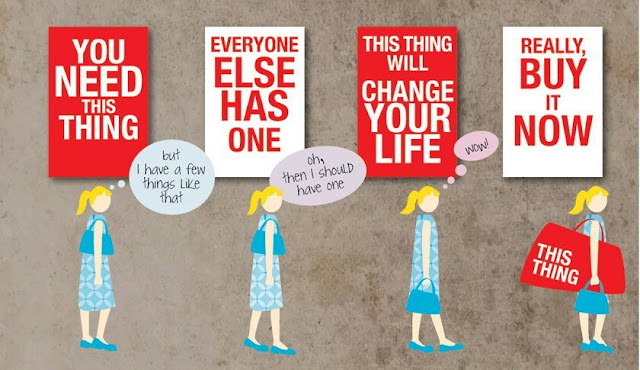

Every dumb thing you own required some ghastly combination of fossil fuels, water, and marketing misanthropy to find its way into your home. Sure, you’re not about to fashion an iPhone out of foraged twigs, but you can put an end to impulse shopping.

Impulse purchases rarely have to do with actual needs — they’re often just an emotional coping mechanism. Who among us has not tried to push away thoughts of inevitable demise with a pair of wedge moccasins that you’ve never worn in five years, not once?

Quitting that nonsense is better for your emotional health, credit card bill, the KonMari balance of your closet, and the war against the capitalist machine.

Fun habits die hard, even expensive ones! But, like us, they do have to die, so I got on the phone with a psychologist — not my own! — to get some advice. April Lane Benson specializes in the treatment of shopping addiction.

- Understand why most impulse purchases happen: Avoiding a responsibility, distraction from some problem, a quick mood boost, capitulation to our society’s obsession with appearances — or, as Benson lightly puts it, “to deny the inevitably of death.” (Heavy.)

- Ask yourself these six questions: Why am I here? How do I feel? Do I need this? How will I pay for it? Where will I put it? What if I wait?

- Wait: What if you do put off the purchase? I don’t know — try it! After 24 hours, see if you still want That Thing.

- Be cart aware: The internet enables impulse shopping because you feel removed from the whole process. You see something pretty, you want it, you throw it in your “cart” that you never touch or see, and you use a credit card that you’ve saved in your browser so you don’t have to actually touch your wallet. It’s really like the purchase doesn’t even happen! Easy solution: Don’t save your credit card information online.

- Carry cash: As much as you can, carry actual money if you’re going somewhere that might be an impulse-shopping danger zone. Maybe it rhymes with “Bephora.” Maybe it’s “Perms and Worms.” Maybe it’s that one insane Target aisle where they keep 30 different kinds of fancy straws. We’re not here to judge! But the more transactions you make with cash, the more aware you are of the actual cost of your purchasing habits.

The primary takeaway: Trying to meet your emotional needs with overconsumption ensures, after all, that your needs remain unmet. A fringed bolero doesn’t return your calls when you’re down, doesn’t bring you Tylenol PM and soup when you have a cold — and if we’re being entirely honest, it doesn’t even look that good on you.

.jpg)

Comments

Post a Comment